Artificial intelligence turns critical for banks facing nimble fintech rivals AI technologies such as machine learning and speech recognition are quietly working behind the scenes to improve lending decisions and prevent fraud. When Swedbank customers face a problem, they reach out to Nina, the bank’s virtual assistant. Visitors to Mizuho Bank are greeted by Pepper, a humanoid robot standing four feet tall. Santander allows payments to be activated by voice, and JP Morgan Chase now uses machine learning to review commercial loan agreements in seconds, a task that used to take 3,6. Wherever you look in the world of financial services, you will find some form of artificial intelligence (AI) at work. AI technologies such as machine learning and speech recognition are quietly working behind the scenes to improve lending decisions and prevent fraud.

Read the latest stories about Tech on Fortune. The US Department of Defense is struggling to get its arms around all of the new security issues that have come with our current technological explosion. One. A virtual assistant is a software agent that can perform tasks or services for an individual. Sometimes the term "chatbot" is used to refer to virtual assistants. Watch Open Season 2 Online Freeform.

Guest blog by Vinod Sharma. Abstract – Blockchain is a mystery story or provides the foundation for cryptocurrencies like Bitcoin. What’s different about block.

AI is coming faster than we can regulate it. Here are just a few of the problems we’re facing. Part 1 of 2: "The Road to Superintelligence". Artificial Intelligence — the topic everyone in the world should be talking about.

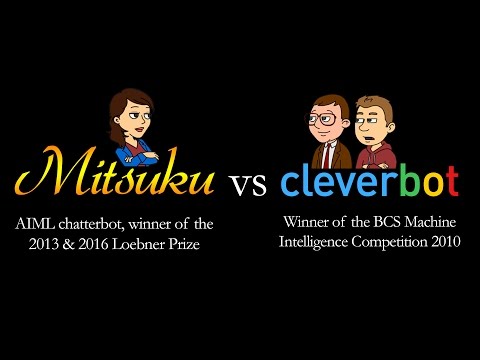

The most visible examples of AI, however, are the customer service rendering digital assistants, and chatbots such as Erica, a. LVin, Eva, and My. Kai, which are becoming familiar names to banking consumers. It has taken 5. 0 years since the launch of Eliza—the first chatbot to mimic human conversation – for the technology to evolve to its current state, where its natural language processing ability is strong enough to answer queries, respond to voice commands, render services, make recommendations and initiate actions. Watch Dark Touch Streaming more. But now, chatbots are going into overdrive, with 8. France, The Netherlands, South Africa and the United Kingdom) intending to use one by 2.

Besides customer service, sales and marketing are two areas where chatbots are expected to play an important role in the near future. That being said, chatbots are just the tip of the AI iceberg. Besides using chatbots to introduce AI into customer interactions, banks are leveraging a bunch of other AI applications to process unimaginable quantities of data and reap benefits of efficiency, differentiation, engagement and experience. Watch Seven Years Bad Luck Online Etonline on this page. Also Watch: This trend is set to grow rapidly.

Our recent report titled ‘Amplifying Human Potential: Towards Purposeful Artificial Intelligence’ indicates that AI adoption is on the rise and by year 2. It notes that a significant part of the financial services sector has been using AI since the past one to three years, and is more invested in the technology as compared to other sectors ($1. For traditional banking institutions facing competition from fintech players which are more nimble, AI is a critical tool to improve customer experience. One such example of this is facial recognition technology, which is 1. In its several other forms, such as advanced virtual assistances and voice assistants, AI software is proving to be faster and better than service agents in responding to customer queries and emails at the contact center level.

When it comes to artificial intelligence, two of the most powerful CEOs in technology—Mark Zuckerberg and Elon Musk—have a major difference of opinion. Add dealmaking to the growing list of skills artificial intelligence that will soon outperform humans, a new Facebook research project shows. Researches at Facebook shut down an artificial intelligence (AI) program after it created its own language, Digital Journal reports. According to the report, the.

Australia’s Westpac is using visual recognition to enable customers to activate their new cards via their smartphones. Barclays have been using voice recognition to authenticate telebanking customers, adding another layer of security to its processes. Japan’s Mizuho Bank and Mitsubishi UFJ are using AI- based robots to manage their front desks and take care of routine customer queries. AI is also being deployed by banks in non- customer facing tasks like credit risk management, where machine learning algorithms identify repayment patterns and predict the chances of default. Then there is the Aidyia hedge fund, which makes all its trades without any human intervention, completely driven by AI.

All these examples demonstrate that AI in banking sector has use cases that go beyond vanilla chatbot implementations. Adoption of purposeful AI will not only improve customer experience but also help banks free up their resources for the next wave of innovation in the financial sector. Banks can no longer hold back on their AI implementations. Yes, there are some challenges, but to wait till AI hits maturity is not an option for a progressive bank. The writer, Mohit Joshi is president, Infosys and head of BFSI, Infosys.